I don’t usually cover news, but I want to highlight some recent finance shenanigans. Much of what I’m doing here is recapping the Wikipedia article, with some additional context.

Trump Media & Technology Group (TMTG) is a company that owns Truth Social—Donald Trump’s alternative to X. TMTG recently merged with Digital World Acquisition Corp. (DWAC). DWAC is a type of company known as special-purpose acquisition company (SPAC). A SPAC is basically an empty shell company, whose entire purpose is to go public (meaning, publicly traded on the stock market), and then merge with a private company so that the private company can be public. SPACs are a method of skipping the usual bureaucracy required to take a company public. (See: educational video on SPACs.)

In other words, thanks to this merger, it’s now possible to buy and sell shares of Donald Trump’s Twitter clone.

The idea of a SPAC is that it doesn’t have any particular company in mind until after it goes public. After all, if they had a particular company in mind, then that all the relevant information about that company would have to be disclosed when going public, which defeats the whole point of avoiding bureaucracy.

On the other hand, that means that investors are giving money to a SPAC without really knowing what that money will be used for. Does that sound scammy? It sounds scammy to me.

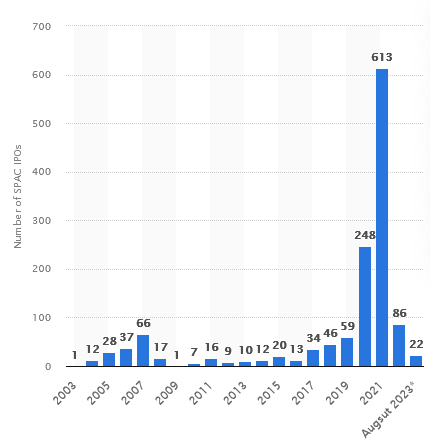

SPACs have been around for a while, but there was a bit of a fad for SPACs in 2021.

Number of SPAC IPOs in the US by year. Source: Statista or see SPACInsider for more.

At the height of this fad, DWAC went public in September 2021. And then in October 2021, they announced that they would merge with TMTG. Only recently, in March of 2024 was this deal finally closed, purchasing TMTG for $3 billion dollars, which experts are describing as “grossly overvalued” based on fundamentals (e.g. user base, revenue).

In the mean time, there was an investigation by the Securities and Exchange Commission. DWAC wasn’t supposed to have a specific company in mind before going public, but there were communications that proved otherwise. In the end, the case was settled, with DWAC being fined for $18 million in 2023. Of course, when you look at that $18M next to the $3B, it’s really more of a fee than any sort of punishment.

More recently, a few people have been indicted for insider trading of DWAC, so maybe there’s some justice. Specifically, they knew that DWAC intended to acquire TMTG before it had been publicly announced, and so they bought lots of shares and then sold at a profit after it was announced. But the upsetting part about this is learning that DWAC went up in share value after the announcement.

Now I’m thinking, is this just a way to launder campaign financing through shady stock market shenanigans? I’m not an expert, and I haven’t seen experts saying it outright, but I have to ask the question. There are multiple articles (e.g.) talking about the boon to Trump’s campaign finances, but they don’t seem to ask the question of whether this is an unethical or illegal way to boost campaign finances. Inquiring minds want to know! Another article, in the NYT, raised the concern that foreign entities would use the company to influence Trump, either by investing in it or by purchasing advertising space. That sounds bad, but surely it’s bad even if it’s coming from domestic sources.

Of course, Trump may not actually see that money. As mentioned in several of my links, there’s a “lockup” period where Trump is not allowed to sell any shares for 6 months–unless he gets an exemption. TMTG is still way overvalued and currently falling, so it may not be nearly as valuable by the time he can sell.

So, I searched the issue on Reddit and I found people talking about it on r/wallstreetbets. I thought, oh god, it’s a memestock. But then I actually looked at what they were saying, and sentiment was very negative. There were some attempts to profit off of the volatility, but they were by and large ridiculing the company. For example, this post describes it as “Taking money from the poor, to fund the riches settlements for having shady business practices.” That was heartening to read.

Leave a Reply