It’s as if America wasn’t the paradise the Right tries to tell us. A Gallup poll shows that a lot of young people want to escape our dystopia.

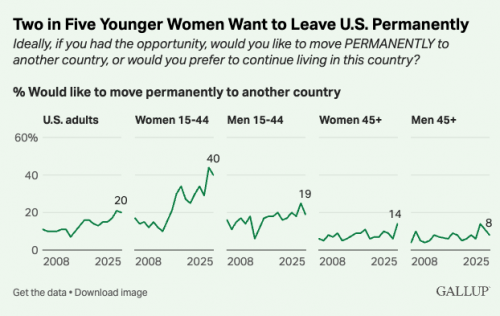

For the second straight year, about one in five Americans say they would like to leave the U.S. and move permanently to another country if they could. This heightened desire to migrate is driven primarily by younger women.

In 2025, 40% of women aged 15 to 44 say they would move abroad permanently if they had the opportunity. The current figure is four times higher than the 10% who shared this desire in 2014, when it was generally in line with other age and gender groups.

A lot of young women want out. It’s hard to blame them.

Young American men don’t feel the same degree of alienation. It also seems to be an American phenomenon — women in other countries aren’t as interested in fleeing their homeland for somewhere else.

The growing trend in younger women in the U.S. looking to leave their country is not evident in other advanced economies. Across 38 member countries of the Organisation for Economic Co-operation and Development (OECD), the percentage of younger women who say they would like to migrate has held relatively steady for years, typically averaging between 20% and 30%.

For much of the late 2000s and early 2010s, younger U.S. women were less likely than their peers abroad to want to move. That changed around 2016. Since then, they have been more likely than younger women in other wealthy countries to say they would leave their homeland for good. By contrast, U.S. men aged 15 to 44 continue to be less likely than average to want to migrate compared with their peers in the OECD.

It’s almost as if women have noticed that we’ve been denying them autonomy and rights.

Too bad there’s no data on the racial, ethnic or educational breakdown of these women. The 15-44 age group is interesting in that these are the prime childbearing years. If MAGA wants American women to have more kids, they’re doing the exact opposite of what’s necessary to entice them to become mothers.

The annual happiness survey has the Scandinavian nations sweeping the winners as the happiest nations on Earth. The U.S. has sunk to 24th. Sooner or later there will be a reckoning. Both for the GOP and the Democrats. Mexico has broken into the top 10.

https://www.cbsnews.com/news/2025-world-happiness-report-us-lowest-ranking/

My two very bright granddaughters (ages 13 & 10) have researched educational opportunities overseas, and have determined that they want to attend college in Scotland, Ireland or England. Their parents will probably follow.

This old woman and her husband both want to leave as well. If they go, perhaps we will.

The other thing US women aren’t doing is reproducing.

There are a lot of reasons for this but a lot of them are a result of how difficult and unpleasant it is to live in the USA today.

These would be falling standards of living, general misogyny, and the feeling that there isn’t any future for the USA that anyone wants to live in.

The fundies/GOP are vaguely aware of this but don’t have any plans to fix this problem.

In fact, their solution is to make it a lot worse.

The current War on Migrants and Immigration removes the reason why the USA isn’t facing a demographic crisis of falling population.

If we don’t reproduce very much and don’t let in immigrants, then our population will eventually inevitably fall like those in much of Asia and Europe.

Source: I made it up

I’ve crossed into the older category, but I’m a man who wants out. I sympathize, ladies.

Count me as one who wants out. But my wife won’t go.

@3 magistramarla

My 11yo granddaughter plans to go to University in France. But that’s been her plan for a while now. Her other grandparents live in Compiègne.

How are expatriate voting rights holding up?

Young women wanting to permanently leave the corporate states of America is not surprising. We have a few known rapists in the highest offices, of course women are saying they are done.

It’s just another version of “Would you prefer to be lost in the woods with a bear or a man?” Of course they prefer the bear.

I know two young women who have already left the country that elects rapists. One is very happy living in Oz, and the other moved herself and her 12 year old daughter from Florida to France. They love France, with its healthcare, lack of Florida men, and delicious foodstuffs.

If one leaves, one should probably become a citizen of their new country; cf. https://www.irs.gov/individuals/international-taxpayers/us-citizens-and-resident-aliens-abroad

“If you are a U.S. citizen or resident alien, the rules for filing income, estate, and gift tax returns and paying estimated tax are generally the same whether you are in the United States or abroad. You are subject to tax on worldwide income from all sources and must report all taxable income and pay taxes according to the Internal Revenue Code.

Many Americans living abroad qualify for special tax benefits, such as the foreign earned income exclusion and foreign tax credit, but they can only get them by filing a U.S. return. For further details, see Publication 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad.

↓

U.S. taxpayers who own foreign financial accounts must report those accounts to the U.S. Treasury Department, even if the accounts don’t generate any taxable income. Taxpayers should file a Report of Foreign Bank and Financial Accounts (FBAR) electronically by April 18, 2022, using the BSA e-filing system. For further details see report of Foreign Bank and Financial Accounts (FBAR).

Taxpayers must also report virtual currency transactions to the IRS on their tax returns; these transactions are taxable by law just like any other property transaction. For more information see virtual currencies.”

—

Interestingly, Eritrea is the only other country that similarly taxes its foreign-residing citizens; cf. https://www.aljazeera.com/opinions/2023/2/20/eritreas-diaspora-tax-is-funding-violence-and-oppression

(So, only two countries on the planet do that, and the USA is one of them)

The backward, irrational superstition that is evangelical Christianity regards women as chattel, livestock, and responsible for our expulsion from the garden of Eden. Disgusting.

@11 John Morales

^^ This, and you should renounce your citizenship of the US. Else you still have to file taxes.

I’m a Dutch citizen, but I went to high school in the US, and had (yes, past tense!) a green card. Upon graduating I GTFO out of that hellhole… But people told me: “keep your green card, it may come in useful!” Only a few years ago I found out I still had to file 25 years of taxes to the US… for a total of $0 to the US, and several $1000 to the tax advisor I hired…

@Robert79

I don’t know what tax advisor claimed you are required to file US tax returns at all, much less 25 years worth of tax returns. You aren’t required to file a return at all if you don’t owe any tax, and the IRS only goes back 7 years as long as you aren’t criminally evading paying taxes.

Sounds more like your tax advisor scammed you.

Tethys, see my #11: cf. https://www.irs.gov/individuals/international-taxpayers/us-citizens-and-resident-aliens-abroad — straight from the IRS.

↓

“If you are a U.S. citizen or resident alien, the rules for filing income, estate, and gift tax returns and paying estimated tax are generally the same whether you are in the United States or abroad. You are subject to tax on worldwide income from all sources and must report all taxable income and pay taxes according to the Internal Revenue Code.

That is, you still need to lodge and report whether or not tax is owed. It is mandatory.

No scam.

Seriously, who would want to stay in a shithole country like the United States…?

Here is what Google Search has to say about living outside the USA as an expatriate.

.1. You still have to file a US tax return.

.2. You probably won’t have to pay any taxes on your foreign income though.

This is covered by the Foreign Earned Income Exclusion (FEIE).

and

Foreign Tax Credit (FTC): This is Form 1116.

In general, the tax laws and tax treaties are set up so that you don’t end up with double taxation.

@John Morales

Resident is the key word in ‘Citizens or Resident Aliens’.

The tax code has zero penalties for not filing taxes, as long as you don’t owe any taxes. If you were a resident holder of a green card with taxable income, taxes are automatically taken from your paycheck, and filing your taxes would likely result in getting a tax refund.

If Robert moved back to where he is a Citizen after High School, he is clearly not Resident.

Of course the IRS codes are best described as Byzantine and needlessly complicated. Many people hire tax experts rather than go through the hassle of finding all the correct forms/schedules and documents that explain the forms.

You can file tax exemption forms if you have multiple consecutive years of completed taxes that demonstrate you don’t owe taxes, and your work status doesn’t change.

Every source tells me the same thing, Tethys.

Even the previous comment to yours notes ”.1. You still have to file a US tax return.”

Do I believe you, or every other source? Hm.

It’s a rule that can be safely ignored, IF you don’t owe taxes. Of course you have to do the taxes in order to show you don’t owe, but as mentioned, you can file an exemption and there are multiple other tax laws that protect from double taxation. 25 years is preposterous since they can only go back 7 years.

There is no penalty. The IRS isn’t going to come after you.

@4 raven

The fundies/GOP are vaguely aware of this but don’t have any plans to fix this problem.

In fact, their solution is to make it a lot worse.

Right. For them, this is a feature, not a bug. They want a theocracy and all that comes with it, so this is not really a “problem”, per se. They think they can make up the difference through forced conversions & births, and offering tax incentives for “quiver-full” families.

Seriously, can anyone point to a society where the tight intertwining of religion and politics didn’t yield a terrible outcome?

“Seriously, can anyone point to a society where the tight intertwining of religion and politics didn’t yield a terrible outcome?”

Depends on definitions and scope.

If the claim targets all societies, then (say) Kalahari and Australian Aboriginal cultures falsify it outright, but of course their versions of religion and politics differed from ours (before their ‘discovery’).

@21 & 22

Most human societies before the last 150 or 200 years had lots of intertwining between religion and politics. The idea that religion is mainly or entirely a private matter is a modern one.

Most modern people wouldn’t want to live in those past societies, but that might be at least as much due to the lower levels of technology and medicine as it is due to different approaches to religion and politics.

springa73, song lines are arguably a type of ‘technology’ — they basically encode information without actual writing, and are embedded in the culture/religion. But yes, I get you.

cf. https://pacja.org.au/article/143975-contributions-from-aboriginal-australian-psychology-songlines-memory-and-relational-knowledge-systems

Not all that surprising. They grew up with the idea that they had rights, at least as a talking point. Even if those rights could be difficult to use in practice.

And now they find that even the talking point has mostly been banished. Because a bunch of dishonest people promote a mass fantasy that overrules their decisions about their own body. If the nation decides you can’t control your own body, what will it be willing to decide about you next?

It’s not like they can just trust the voters. They just voted the guy who openly treats them like objects rather than people to one of the most powerful single positions in the world. On a farcical claim about lowering egg prices if all things. While he was rambling incoherently about people eating dogs and cats. If something that obvious and absurd worked last time, how little will it take next time? And what if someone a bit less cuckoo took over instead? What kind of damage could they do?

[addendum, hopefully interesting]

Interestingly, because they’re not written down songlines adjust in real-time as the world does, and can incorporate environmental changes such as new waterholes or different animal patterns or even climate change (30k years plus!). They also register social shifts such as clan boundaries, ceremonies, and who holds what knowledge in real time.

Main ‘problem’ is propagation speed and scalability beyond the local community, but then, that kinda makes things like kingdoms and empires impractical — but then, that makes an industrial age also impractical.

Anyway. They were actual societies that actually existed.

I was reading an article during the last Trump government that was about expats, which said “The American dream has now become to leave America.” To which I can only say, yes. These were often people, retired or working, who just couldn’t afford indentured-servant jobs, no child care, no health care, as well as unchecked misogyny. So, they went elsewhere. I would think that young women would be motivated, in part, by the same things.

It’s not that I particularly want to leave, and I would like to stay and fight fascism and fight for social justice for the people who are vulnerable or who can’t escape. It’s just that, for safety’s sake, I have a country and a region all picked out and have read up on relevant visas, permanent residence, citizenship, and taxes. I’ve made sure that my passport was renewed, is up to date.

I’ve been reading up on when the scientists who successfully got out decided it was time to flee Europe before WWII. I mean, what fascist events were happening that convinced them it was time get out. It’s getting kind of close to those here now.

But, I’ve been ill for a while and cannot take any practical steps about this. I’ll still be here at the time of greatest danger, the 2028 “election.” So, I will just have to see what I can do.

The Exodus began long ago. More than 30 years ago I was meeting Americans who had fled to Australia to escape the impending downfall of the USA. Most of them were nice people fleeing the corrupt politics of a state on the slippery slope to fascist authoritarianism. However, I capitalise “Exodus” because for some it was a biblical motivation. They brought exactly what many were fleeing, their guns, God and the flag. Unfortunately they also brought the associated virus with them.

When in doubt, read the instructions. Specifically, pp. 8-11.

https://www.irs.gov/pub/irs-pdf/i1040gi.pdf

Chart A—For Most People

IF your filing status is . . . THEN file a return if your gross

Single

under 65 $14,600

65 or older $16,550

Married filing jointly***

under 65 both spouses $29,200

65 or older (one spouse) $30,750

65 or older (both spouses) $32,300

Married filing separately

any age $5

Head of household

under 65 $21,900

65 or older $23,850

Qualifying surviving spouse

under 65 $29,200

65 or older $30,750

*If you were born on January 1, 1960, you are considered to be age 65 at the end of 2024. (If your spouse died in 2024 or if you are preparing a return for someone who died in 2024, see Pub. 501.)

**Gross income means all income you received in the form of money, goods, property, and services that isn’t exempt from tax, including any income from sources outside the United States or from the sale of your main home (even if you can exclude part or all of it). Don’t include any social security benefits unless (a) you are married filing a separate return and you lived with your spouse at any time in 2024, or (b) one-half of your social security benefits plus your other gross income and any tax-exempt interest is more than $25,000 ($32,000 if married filing jointly). If (a) or (b) applies, see the instructions for lines 6a and 6b to figure the taxable part of social security benefits you must include in gross income. Gross income includes gains, but not losses, reported on Form 8949 or Schedule D. Gross income from a business means, for example, the amount on Schedule C, line 7, or Schedule F, line 9. But, in figuring gross income, don’t reduce your income by any losses, including any loss on Schedule C, line 7, or Schedule F, line 9.

***If you didn’t live with your spouse at the end of 2024 (or on the date your spouse died) and your gross income was at least $5, you must file a return regardless of your age.

Given that the US has reciprocal tax treaties with most nations on the planet (not Iran, North Korea, etc), generally, if you live and work overseas, your taxes go to your host country, not the US. Because double dipping and excluded income. Usually you are only taxed by the country you live in, unless you have foreign taxable income from another country, in which case you MIGHT be liable for taxes in the country that income was generated.

https://www.irs.gov/publications/p570

Apparently it all comes down to bona fide residence and physical presence.

@20 Actually the IRS can go back a lot further than 7 years if they determine you filed a legally inaccurate tax return or if you filed a false/criminal tax return. It’s how they got Capone. If Capone had filed a tax return that fully disclosed all his illegal income, put “organized crime boss” in the profession box and signed it, he’d have gotten off scot free. It’s a problem that marijuana growers have in the US–the federal government doesn’t recognize cannabis as legal but you still have to pay taxes on ALL income so yes, growers & sellers HAVE to declare that income on a US tax return. Even though some states legalized cannabis, the federal government has not.

So, women & teenaged girls in their childbearing years might want to immigrate to a country that recognizes their bodily autonomy, provides universal healthcare and in some countries, gives money, tax credits, housing breaks AND public childcare to women who are having children and yet somehow, people are confused as to why these women might want to leave the US, which has the highest infant mortality and childbirth deaths of pretty much all the industrialized nations? Inconceivable! (as spoken by Wallace Shawn.)

Inconceivable! Indeed.

@16. Autobot Silverwynde : “Seriously, who would want to stay in a shithole country like the United States…?”

If the USA wasn’t a shithole coutnry before Trump it sure is now and getting shittier all the time. MAGA huh?

Yet even with all the crap going on in the States there are still Canadians who want to immigrate there because they think they will make more money and pay less taxes. Or for stupid reasons. I briefly read some posts from a forum for Ontario high school grads the other day. One kid, and his writing style makes me suspect he’s a pretty young teen, wants to go to the US so he can own a “defense gun.”

@silvrhalide

Actually I very clearly stated that there is no penalty for not filing as long as you don’t owe taxes. That obviously doesn’t apply if you are committing the crime of income tax evasion. Just ask Willie Nelson.

Or Wesley Snipes.

I can’t blame them. If I weren’t a poor slob, I’d finally leave this capitalist, Christian shithole once and for all.

@timgueguen #34:

I guess we’ll take ’em, eh? They’ll blend right in with all the other types of stupid here. MAGA is just Make America Geriatric Always since at least partway through the first Trump presidency. And as for the future… the forecast is simple. We have an old man yelling at clouds and a lot of cloudy days ahead. And nobody would give a damn about any of it if he weren’t propped up by so many other whackaloons, fellow conmen, and opportunistic hangers-on.

Oh and for your friends who might think the US is cheaper, tell them they pay that tax every time they spend any money. You had anything to do with healthcare whatsoever? Great! You just paid into feeding tens of thousands of extra mouths whose only purpose for being involved is to take your money. You buy groceries? Great! You’re paying for everyone involved to have healthcare or for disruptions because they don’t. And the vast majority of any of that isn’t going to the workers either. It’s going to parasites whose only purpose is to be more aggressive parasites. Everyone else gets barely adequate pay at best.

@4 raven

The other thing US women aren’t doing is reproducing.

Nor are women anywhere else.

For some reason, a couple of months ago, I pulled down some fertility data for every country in the UN from the World Bank (Up to 2023) and ran some graphs.

A lot of developed countries are hovering in a band probably from about 1.66 – 1.25 roughly. I’m too tired at the moment to run the numbers but I should try this tomorrow.

It looks like for most countries, fertility rates started declining about 1970 and have just kept on falling.

India is mind–boggling. In 1968 FR = 6 and in 2023 FR = 2. The decrease was almost perfectly linear. So much so I thought that I had messed up my coding.

I get a correlation of -0.99. I still wonder if I’m doing something wrong.

Um, yes they are.

Most recent USA data I can find: https://www.cdc.gov/nchs/data/vsrr/vsrr038.pdf

↓

Abstract

Objectives — This report presents provisional 2024 data on U.S. births. Births are shown by age and race and Hispanic origin of mother. Data on cesarean delivery and preterm births are also presented.

Methods — Data are based on 99.92% of all 2024 birth records received and processed by the National Center for Health Statistics as of February 4, 2025. Comparisons are made with final 2023 data and earlier years.

Results — The provisional number of births for the United States in 2024 was 3,622,673, up 1% from 2023. The general fertility rate was 54.6 births per 1,000 females ages 15–44, an increase of less than 1% from 2023. The total fertility rate was 1,626.5 births per 1,000 women in 2024, an increase of less than 1% from 2023.

@ Morales

Dude! What nonsense is this? “Less than 1%”, lol.

https://usafacts.org/articles/how-have-us-fertility-and-birth-rates-changed-over-time/

Honestly, your desire to troll routinely has you making an utter spanner of yourself.

@35

Yes you did,

You are also wrong.

If you read the link I provided, which is a link to the IRS, you would see that the table listed on pp. 8-11 is to determine whether or not you have a filing requirement. IOW, if you have income above the amounts listed in the chart, you MUST file, regardless of whether or not you are getting a refund. If you have a filing requirement and don’t file, you can get hit with a failure to file penalty, even if you are getting a refund.

If you got Obamacare for any part of a tax year, you have a filing requirement regardless of income, because when you sign up for Obamacare, you are basically guessing how much money you will make during the year. Your income level, number of people in your family and fling status determines the size of the federal subsidy–the thing that Congress was ostensibly fighting about for the last month and a half–you will get towards your healthcare premiums. If you don’t file and reconcile actual income with estimated income, not only do you get hit will a bill for the money the feds already spent on your healthcare premiums, you are also ineligible for any government assistance for your healthcare for the following year or until you actually file the required tax return. So you can still get hit with a failure to file penalty even if you don’t owe any money to the IRS.

https://www.irs.gov/affordable-care-act/individuals-and-families/the-premium-tax-credit-the-basics

Also, tax evasion has certain legal ramifications and requires active intent to defraud the federal government. Tax delinquency is a failure to file a tax return when you have a filing requirement but lacks specific intent. Those are two different things.

@34 Does he want to get shot by a “defense gun”? Because depending on where in the US he decides to move, his chances of getting shot by one might be quite good.

Still trying to figure out what a “defense gun” is.

Tangentally, HBO has a pretty good documentary about the protection industry for school shootings, Thoughts and Prayers, that the little idiot might want to watch.