Her correspondent Michael Rubens tries to understand why Republicans are so infatuated with tax cuts for the rich and with economist Arthur Laffer’s theory that such cuts will lead to massive economic growth.

As Rubens points out, Sam Brownback ran this exact experiment as governor of Kansas and the result has been a disaster for the state’s economy, as even the heavily Republican legislature there acknowledges. But Brownback, now like New Jersey’s Chris Christie one of the least popular governors in the country, is leaving it to someone else to clean up the mess he created and is bailing out before the mobs come after him. He has accepted Donald Trump’s offer to head the Office of International Religious Freedom in the State Department, an office that must be one of the most obscure and useless in the government. His “mission would be to monitor and respond to threats to religious freedom around the world.” In other words, do nothing but make speeches even though nobody in the rest of the world will give a damn what he says.

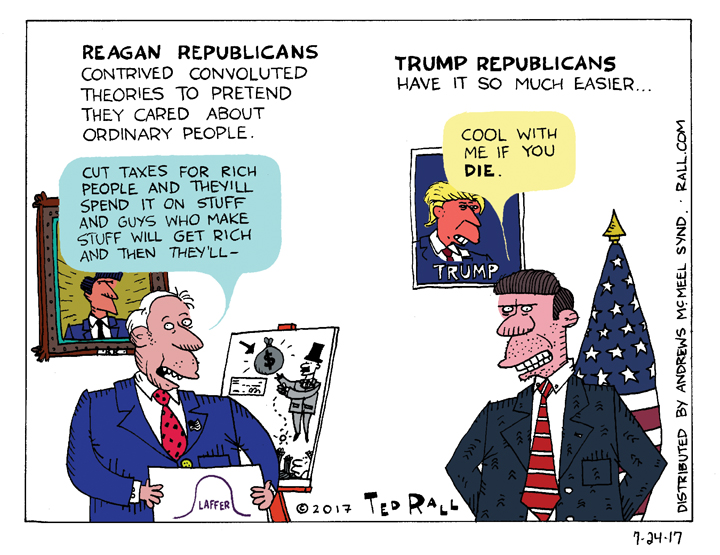

But as Ted Rall says, Republicans do not need Laffer anymore to provide them with some intellectual cover for their efforts to give more money to the rich. Now naked greed has taken over.

I don’t think they really believe any of that. Do you? Perhaps a small, few, of the more stupid ones -- but mostly it’s just that they’re serving the interests of the rich because something something maybe they’ll be rich someday.

The Laffer curve would actually be a fairly good point, if not for the assumption that we are on the far side of it.

Marcus: Never underestimate the ability of another human being to believe some self-serving nonsense that is gently and skillfully massaged into their brain. Especially when the ones doing the massaging have figured out how to make a profit off of it. I mean, think about it. Advertising works. By comparison, this is just an old-school version of a phishing attack that targets rich people and attempts to form a symbiotic relationship.

Patriotism (in case someone else reads this) is something similar that targets more people: the idea that being on one side of a bunch of imaginary magic lines makes one better than those on the other side, that flag waving and chest pounding by people on this side of said lines is heroic while the same by people on the other side is questionable if not downright scary. Why do we believe something so obviously silly and unfounded? For the same reasons rich republicans believe in tax cuts leading to magic economic growth; because we’re told so convincingly, in an uncritical context, and it’s self-serving.

Holms @#2,

There are two points on the Laffer curve that are correct. O% taxation will give zero revenue and 100% taxation will also give zero revenue. But there are an infinite number of curves that connect those two and which curve is the correct one and where we currently are is utter guess work.

Mano @#4,

Even that’s not true. 100% taxation won’t give zero revenue; there are lots of people who would happily work with 100% taxation, either to support everyone or just because what else are you gonna do. If all my needs were taken care of but I didn’t get to keep any of the money, I would keep building satellites cause it’s fun! I can well believe it would reduce productivity, but certainly not to zero.

So, one point is correct, and one is kinda right but not exactly, and in between who knows? Well, as the report mentions, Kansas knows -- we’re clearly on the part of the curve with positive slope. And also you can correlate economic growth with tax rates in the entire history of the US (and include whatever lag you want), and what you get is that higher tax rates are (very slightly) correlated with higher growth. Yup, if anything Laffer has it backwards. Most likely it just doesn’t matter that much either way. Although it is worth noting that the two worst economic collapses in US history happened shortly after a major reduction in tax rates.

I wouldn’t object to 100% taxation as long as it was accompanied by 100% redistribution (assuming that the military/industrial complex and medical/congressional complex didn’t get 40% of the pie)