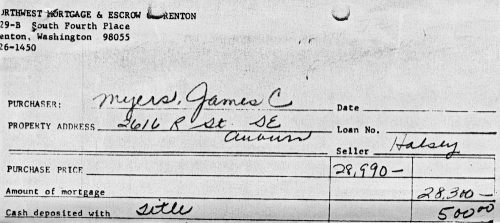

You will either be amused or horrified by my discovery of the documents leading to the original sale of my mother’s house. My mom & dad bought this place in 1976, the first and only home they would own, for this amazing price:

That’s right $28,990, and they bought it with a $500 down payment. My father’s income at that time was, I think, somewhere in the neighborhood of $10K, so it was a bit of a stretch for them.

This is the same house I’m selling for $435K now.

The housing market is stark raving nuts. Boomers had it relatively easy.

My mom & dad bought the house I grew up in for 35k in 1974. It was south of Hillsboro, Oregon — an area that would later be suburbs of Portland, but when the house was bought was still accessed by a gravel road with a large wheat field behind us. (The areas along the access street to our home, which was at the end and would eventually be a paved cul-de-sac, were already zoned to be built up into a suburb, but it wasn’t filled in yet, and it wouldn’t be til high school that the wheat field behind us got sold off to become a subdivision, so I was at the boundary between suburbs and rural land almost that whole time — the best description back then would have been “exurbs” but it’s a word not familiar to most people.)

It was a little more expensive than your parent’s house, purchased a couple years later, but our house was pretty big and it was new construction, so…? Yeah. The price there doesn’t exactly surprise me. Within a couple years and within 25%. Totally a reasonable variance for location & new construction, etc.

What’s disgusting to me is that I bought a house for $125k in Portland proper in 2004 and the same house today is worth well over 400k.

WTF?

In inflation-adjusted terms, $28,990 in 1976 would be equivalent to about $161,000 today.

However, if that $28,990 had been invested in the stock market and seen average returns, it would be worth $5.9 million today in 2024 dollars.

my wee condo in trailer park land, 320k with years of neglected work to do on it. less square footage than my last apartment.

As a millennial I’m going to need this concept of “buying” property explained to me. That can’t have been a thing, can it?

My grandparents bought a house in Oxford (UK) a few years earlier for 10,000 pounds – although rather like today, they could only afford it thanks to the Bank of Mum and Dad (my grandmother’s father died, and my grandmother’s mother helped them with the money in exchange for them converting part of the house into a flat for her). I looked up an estimate of the value today – 765,000 pounds.

My parents bought a house in 1964 in a small college town in Missouri. $15K! My dad said the payments the first few months almost killed him. It was a large house on a quiet tree-lined street with pocket doors, stained glass, and a lovely wrap-around porch.

When I first got married (1985) and interest rates were in the teens, my father-in-law recounted how the bank would call every few months and BEG him to refinance his mortgage. He would just laugh at them and hang up. His interest rate was 6% which seemed absurdly low to me at the time.

Our first home-purchase in a Milwaukee suburb was in 1990 at $97K. We couldn’t have done that without my 0% down VA loan, and I remember the payments almost killing me for the first few months until we adjusted. Where I live now $100K wouldn’t buy you a garage!

“Oh the times, they are a changin'”

We’ve been looking at houses to move to a new area and looking at their history of sales over the years. Most have sold every 6-7 years and have doubled at each sale. Wages absolutely have not done that, especially over the past couple of decades: in real terms they’ve been close to flat. Wages are just starting to rise a bit now in Australia (still behind the rate of inflation though, in most cases), but until we stop treating housing as an investment and start treating it as a human right, a roof over one’s head will continue to get more and more out of reach.

Housing prices in the USA have been rising far faster than the rate of inflation.

And, in terms of affordability, far faster than the rises in median income.

In 1990, the house price to income ratio was 3.1, national average (actually they used medians).

Meaning if the median income was $30,000, the median house price was $30.000 X 3.1 = $93,000.

It is now 5.6, an increase of 81% in the lack of affordability ratio.

That is the data. Houses are now far less affordable than they were decades ago. In fact, today is the record for least affordable housing market.

If it seems like life is harder today for Americans, that is because…life is harder today for Americans.

Prices for many necessities have outpaced income growth.

As a Boomer, I can say it.

Life is harder today for young people than when I was a young adult.

This is ominous because, life wasn’t all that easy for us as young adults. There was the Vietnam war, followed by Nixon, and then Reagan.

.1. Tuition was something like $600 a year at the good state U. I went to. Today it is $12,500.

It was common to graduate debt free.

Student loans just weren’t that big a thing back then.

.2. We’ve already dealt with housing.

They were much more affordable back then.

.3. Internet computers and connections.

These didn’t exist back then in the 1970s.

Today they are a necessity. The whole world runs off the internet.

.4. Cell Phones.

Same thing.

Something like 97% of the US has cell phones.

A necessity.

.5. Cars?

I didn’t look this up so I can’t really make any comparison.

I do know car insurance just keeps going up and up though.

.6. Medical and dental care.

Outpacing incomes as well.

There you have it.

It is much more expensive and harder to have a minimal middle class existence today than it was 50+ years ago. This is in real buying power terms of the median income.

This explains a lot of why young people today aren’t having children. The US fertility rate is 1.62, way below replacement.

The MEDIAN house in San Jose, CA is over a million dollars, the highest in the country. San Jose has about 1.3 million people, and most are working class (and therefore not homeowners).

@ANB, Both San Jose and Santa Cruz have median house prices of $1.4M, but the median household income in San Jose is $136k, but in Santa Cruz only $105.6k. So that means a price/income ratio of 10.3 in San Jose, but 13.3 in Santa Cruz. Both ratios are much higher than the nationwide 5.6 that Raven cited.

I was just thinking about this topic. My mom actually just passed away today after a long 7 year battle with Parkinson’s Disease Dementia (aka Lewy Body Dementia). She had just turned 79. I thankfully don’t have to go through probate with her estate since it was put in an irrevocable trust and I only have one sibling to split it with, but it’ll still be an unnecessarily long and complex road to get everything sorted out, especially since I still live here as I was her fulltime caregiver, but I don’t plan to stay. I’m actually moving to Alaska!

She bought this current house at a steal for about $115K in 1997 and it’s now worth nearly 3x that much. That made me think of my parent’s first house in Ocean City, Maryland, where I grew up. It was built in 1967 and they bought and renovated it in 1970 for about $17K. It’s a waterfront property and is now worth nearly a half million. It’s been renovated a lot since my parents sold it for $75K in 1988, but that price still blows my mind for a house that’s barely over 1200ft² on a tiny plot of land with a canal in the backyard. I loved that little house. I’d buy it back, but I can’t afford it, nor do I want to stay on Delmarva. It’s long past time for me to move on.

mathscatherine @#5

My parents bought a house in Oxford sometime in the fifties for £5,000. We sold it in 2008 after my dad went into a residential home. We were very lucky, the buyers had offered £650,000 just before the crash, but we hadn’t exchanged contracts, however they went through with the sale at that price. They were a couple of retiring academics who had lived in London and just the two of them were going to live in the house that my parents had brought up six kids in. And that price was taking into account that the house needed rewiring, re-plumbing, a new heating system and double glazing! The only reason I live where I do is I got a sixth of that money and put most of it into this house. I do know how lucky I am.

$435,000 sounds incredibly cheap to me. Where I live you would have trouble finding a flat tor that.

My father bought a house in inner West Sydney for AUD 17,000 in 1966 – and sold it in the 90s for AUD340,000. Now for the same house you would need AUD1,500,000. Credit is the cause. It is a consequence of the economic regime since the 1980s – of tight fiscal policy and low interest rates – making increasing private debt necessary to an expanding economy. And rhus policy mix is 100% responsible for rising inequality.

@9 raven

As to cars, this page was one I found with a quick look:

https://blog.cheapism.com/average-car-price-by-year/

Seems it started out in the “just below $1,000” range in the 30s, wobbled a bit, sometimes going up, like during the war, then going back down again, staid in the 4-5 thousands range, with again, some drops in price here and there, until the 60s, where it momentarily jumped to over $6,000, then dropped back to the $3,000 range. It went up and down a bit until around 1980, when it suddenly jumped to around $8,000, wobbled up and down a bit again, then around 1988 it started seriously climbing, into the over $10k range, and while the prices have continued, year after year, to drift up and down, they averaged between $12k and $22k (as for 2003, which is the last date given on the page). I don’t doubt they have gone above that as well, in the years since.

Compared to housing, its been both weirdly variable, and somewhat stable, but definitely still rising.

This one: https://www.in2013dollars.com/New-cars/price-inflation

has and inflation chart. Again, 1957 saw a huge spike, probably due to a boom in sales, after the war, and increased demand, but in general… without crunching numbers I would say, with the ups and downs, the average has been maybe 6-7%?, maybe. The page doesn’t make it clear, but there are almost as many drops and increases on the chart, and the average is possibly around that, if you leave out the massive one in 47. Though, it might be higher. I really don’t feel like doing the actual math. lol

@ Kagehi

Just recently, new car prices have spiked again.

For 2024, the average sale price was $48,397.

That is high.

A few decades ago, you could buy a house for that.

I looked up a few common makes and models.

These are all new 2024 prices.

A Toyota Corolla runs around $24,000.

Honda Civic $24,000

Toyota Tacoma pickup $33,000

Ford F150 pickup $40,000

Toyota Rav4 $30,000

The entry level econo boxes look sort of reasonable.

Everything else looks expensive to my eyes.

The Ford F150 is a giant pickup these days.

The last few years have been crazy.

We bought or mildly run down home in 2016 for 130k. My friend bought a house up the street (they’re all basically the same original design) with less space (ours has an extension) an just some minor renovations for more than twice the price. We were just very lucky.

Coincidentally, there is an article today on how expensive cars are these days.

Here is the bottom line.

That’s a jump of almost $10,000 from October 2019, ahead of the pandemic. That means new car prices have risen much faster than most goods and services.

I didn’t even know the American car manufacturers are no long even making cars. It’s all SUVs and giant pickups.

If you just want a car car, you have to buy foreign.

Which isn’t a problem.

When Detroit Big Iron became obsolete due to rising gas prices, people were more or less forced into buying Japanese, Asian, and European cars, ironically enough often made by Toyota etc. in the USA.

It worked out OK.

They are very good cars, especially at the prices they charge.

Why on Earth would anyone here be contemplating a move to Alaska of all places? Not just a red state, but the one that’s turning into quicksand and that Sarah Palin came from!

My wife’s parents died recently. They bought their house in Vancouver, BC for $17,000 Cdn in 1967. It was already old then, having been built in 1912. It sold last year for . . . .

$1.5 million.

Canadian home prices are rrreeaaalllly fucked-up!