Seems like just a few centuries ago when I was blissfully happy in my generic middle class existence, but it’s only been five years. Little did I know the initial crash of Lehman followed by the banking crisis would spell the end of that and almost mark the end of my life:

BostonGlobe.com — The financial crisis following the Lehman bankruptcy was the most challenging, terrifying time in my 30 years in the investment business. Financial markets practically froze, the banking system nearly collapsed, and the global economy — not just the United States’ — contracted sharply, leading to the deepest recession since the Great Depression.Now, five years after Lehman’s collapse, what have we learned? Have we fixed the problems that precipitated the financial crisis? We have identified many of the root causes of the crisis and reduced the risks of another one. But we have by no means eliminated the risk.

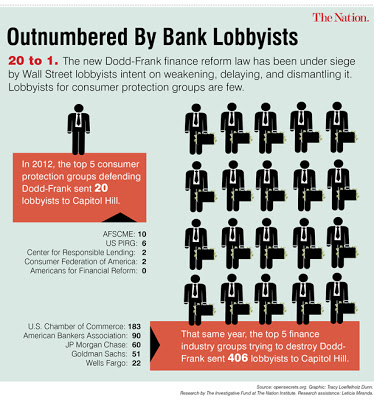

Major financial reforms have been enacted, such as the Dodd-Frank Law passed in 2010, but scores of rules still need to be written, illustrating the complexity of both the law and the financial services industry. I remain hopeful, but also skeptical that new tools and new rules will allow regulators to spot future financial bubbles — and stop them before they burst. I’m also skeptical that financial reforms have adequately addressed the problem of “too big to fail” and the need for future bailouts. We won’t know if these measures will work until the next crisis hits.

BTW the guy who wrote that op-ed is a director of credit research at a Boston firm, credit research as it turned out was one of the most corrupt, rotten roots that felled the diseased Wall Street tree. I’m not sure what the author means by terrifying, maybe he actually did experience some fear, but my guess is terrifying as used above doesn’t include being thrown homeless into the street or being kicked off health insurance in the middle of chemo or anything like that. Which is exactly what happened to a whole bunch of decent humans being because of these sick fucks who ought to be dead or in jail for life. Terrifying these assholes means a reduction in year end bonus and an under performing stock purchase plan.

If I ever run into one of these bastards in real life, I will try, I will honestly try and I’m pretty sure I’ll succeed, in not raining punches and kicks down on them until they crawl away bleeding and whining. I have to wonder, how bad does someone have to fuck up before being lynched or feeling an overpowering urge to commit painful ritual suicide?

Meanwhile, Scar is on Morning Joe lecturing the middle-class and working-poor on why it’s a bad time to mess with minimum wages and general econ 101, you know, five years after conservative economic ideology failed so catastrophically that the Bush admin had to borrow a page from the left and nationalize banks and insurance companies to keep them solvent. The sickness runs deep.

Speaking of catastrophic failures and those poor beleaguered banker CEOs, where are they now?

Public Integrity — Many of the top Wall Street bankers who were largely responsible for the disaster — and whose companies either collapsed or accepted billions in government bailouts — are also unemployed. But since they walked away from the disaster with millions, they’re juggling their ample free time between mansions and golf, skiing and tennis. … Take Richard Fuld. Five years after Lehman Brothers Holdings Inc., the 158-year-old company he ran, collapsed under the weight of bad investments and sent a tidal wave of panic through the global financial system, Fuld is living comfortably.

He has a mansion in Greenwich, Conn., a 40-plus-acre ranch in Sun Valley, Idaho, as well as a five-bedroom home in Jupiter Island, Fla. He no longer has a place in Manhattan, since he sold his Park Avenue apartment in 2009 for $25.87 million.

Aww, only 25.87 million? ZOMFG that’s terrifying!

I wish we had nationalized them. We actually bought them and handed them back to the managers that cause the mess.

You have far more willpower than I do.